Family Child Care Home Provider Business Support

Tax Tips for Registered Family Child Care

Don’t Let Tax Time Get You Down! We have resources to help!

Getting Ready for 2024 Tax Returns: Family Child Care Provider Tips.

Don’t Let tax Season Get You Down: Know The Basics!

Recorded Webinar with Q&A for 2023 Tax Returns:

2024 Taxes (for filing taxes in the Spring of 2025)!

On March 21, 2024, Child Care Aware of New Jersey held a tax preparation webinar going over basic concepts, business expenses, shared expenses, IRS forms, and worksheets and templates to help FCC providers. If you missed the session, you can watch the recorded video. The slide presentation is also available in English & Spanish.

Tax Concept One Pagers – Simple Explainers

- The Time-Space Percentage Explainer. The time-space percentage is important because this is the percentage that is applied to shared expenses (i.e., expenses that are partially business related and partially personal) when adding deductible expenses to your tax forms. English & Spanish

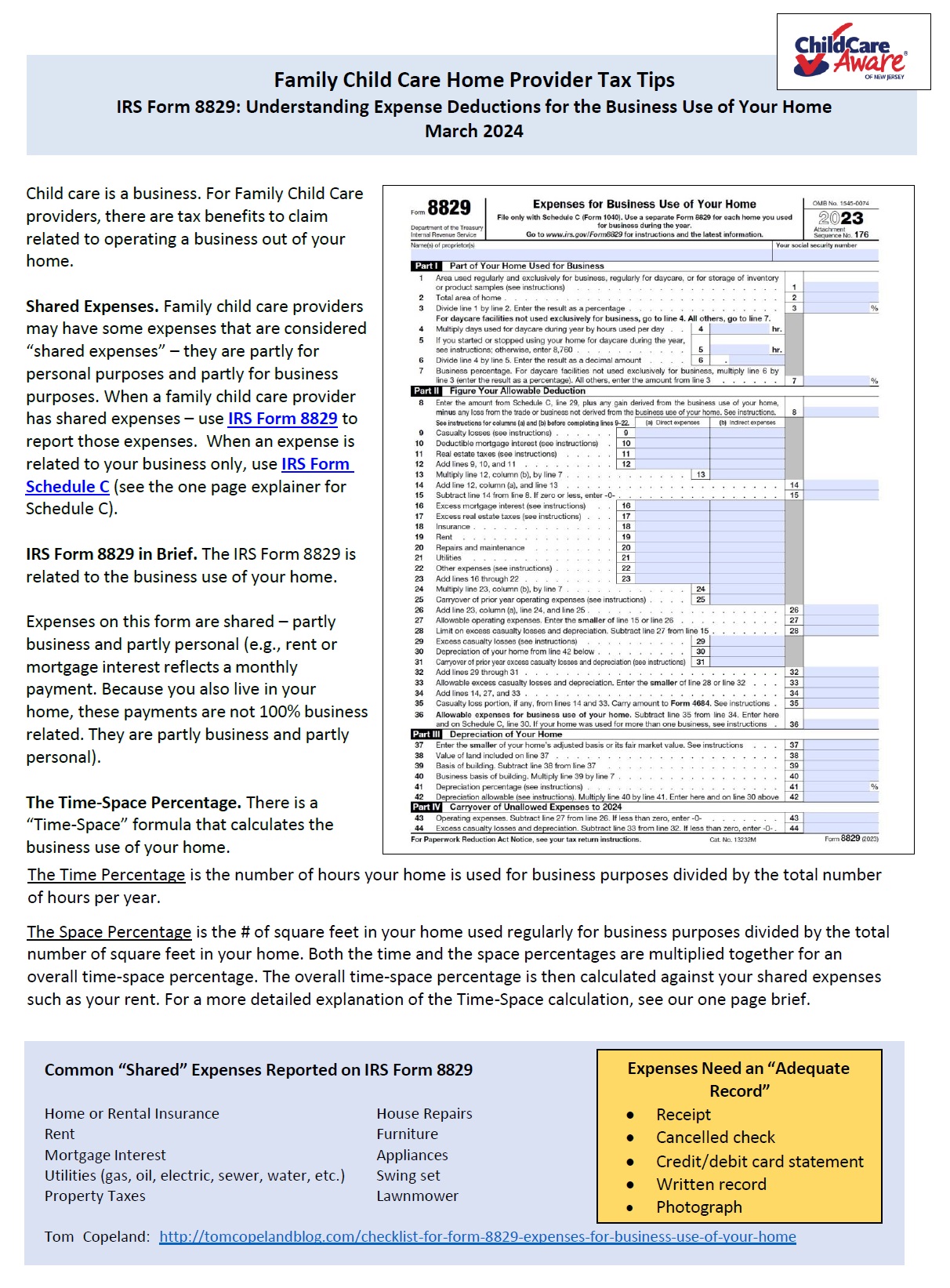

- IRS Form 8829 Explainer. This is the IRS form where you list shared expenses. The time-space percentage is used for the calculation on this form. English & Spanish

- IRS Schedule C Explainer. This is the IRS form where you list all your expenses that are 100% related to operating your business. English & Spanish

Worksheets & Tools to Make Filing Taxes (and record-keeping) Easier!

- IRS Schedule C Expense Worksheet (Explained Expense List adjacent to IRS Schedule C Form, March 2024) English & Spanish

- IRS Form 8829 Shared Expense Worksheet (Explained Shared Expenses List adjacent to IRS Form 8829 Form, March 2024) English & Spanish

- Time-Space Worksheet (Excel tool to calculate time-space percentage, March 2024) English & Spanish

- Time Tracker (Use this worksheet to track your working time every day/every week to prepare for the time-space percentage used in IRS Form 8829 — not just the time you spend caring for children but all the other things you do to support your business) English & Spanish

- Monthly Attendance and Payment Log (Excel, use this template to track child payments & Monthly Meals & Snacks). English & Spanish

- Monthly Business Expense Log (Excel, use this template to track business expenses to support your FCC program) English & Spanish

Time-Space Percentage 1 Pager

English & Spanish

Time-Space Percentage 1 Pager

English & Spanish

Time-Space Percentage 1 Pager

English & Spanish

Check out the business resources in the NJ Shared Resources Platform online family child care toolkit!

- Discounts on frequently purchased products

- Financial management and templates

- Record-keeping forms and parent contracts

- Forms and policies

- Creating a profit & loss statement

- And more!

Contact your Child & Families Resources staff if you need help gaining access to the NJ Shared Resources Platform. Staff can also help identify resources in the toolkit to help with your day to day work. Download this cheat sheet of resources contained in the platform.

Marketing Resources

The NJ Shared Resources Platform has a wide array of marketing resources – including a list of 25 no cost (or low cost) ways to market your program!

- Email marketing for Beginners (Video)

- Google Ads for Beginners (Video)

Basic Business Resources

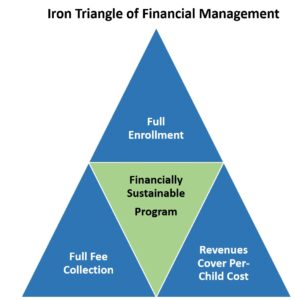

- FCC Financial Management Toolkit (Opportunities Exchange)

- FCC Financial Management Self-Assessment (Opportunities Exchange)

- FCC Budget Template | Provider (Excel Download, Opportunities Exchange)

- Frequently Asked Questions (Opportunities Exchange)

- Child Care Management System Software Frequently Asked Questions (FAQs)

Federal Help for Child Care Businesses

- Small Business Administration (SBA): Support America’s small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow their businesses.

- Women Owned Business Center: Find your local Women Owned Business Center for support for women business owners.

- Score: The nation’s largest network of volunteer, expert business mentors. They have helped more than 11 million small business owners since 1964.

Access to Capital – Loans

Emergency Planning

Federal and state laws require all regulated child care businesses to have an emergency plan. There are many templates. Contact Child & Family Resources staff today for help in drafting your plan!

Thriving by Three

The Thriving by Three Infant and Toddler Child Care family child care home grant will help support the development and creation of infant and toddler slots and provide technical assistance to providers for the expansion of child care spaces.

How-To Documents

- Submitting an Application Video

- Webinar Recording English | En Español

- Overview PDF English | En Español

Eligibility Summary – Eligible Providers must:

- Comply with state and federal health and safety requirements for registered family child care providers.

- Comply with the current family child care registration standards for infant and toddler child care, including, but not limited to, child-to-staff ratios and health and safety standards.

- Be in good standing (no enforcement action and/or funding misrepresentation investigation or misuse of funds)

- Use the funds to develop or expand quality child care spaces.

- Participate or apply to participate in the state’s child care quality rating and improvement system, Grow NJ Kids, no later than 12 months after initial grant approval.

NJEDA Child Care Facilities Improvement Program

In 2023, NJEDA accepted applications from child care centers for facility improvement. The agency expects to offer a similar program to registered family child care homes in 2024. Stay tuned for additional information.

Tools You Can Use to Support Your Registered Family Child Care Home!

Overview Resources:

Child Care Aware of New Jersey